This AI UPGRADE Showcase spotlights companies that aren’t just dipping their toes in AI – they’re diving in headfirst. These organizations show us what happens when you stop seeing AI as a tool and start seeing it as a strategy.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

🔍 The Innovation Snapshot

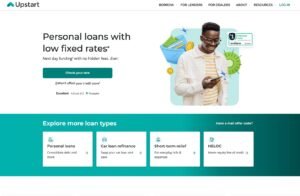

⇒ Company: Upstart

⇒ Founded: 2012

⇒ Sector: Financial Services

⇒ AI Application: Alternative credit scoring and automated lending

⇒ The Big Idea: Using AI to see beyond FICO’s tunnel vision

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The Problem AI Solved in Lending

Let’s talk about the elephant in the financial room – FICO scores.

They’re like trying to judge a chef by only looking at their knife skills. Sure, it tells you something, but it misses the whole feast of information that actually matters.

Real-life consequences:

Think about it …

- A recent graduate with stellar earning potential gets rejected for a loan because they haven’t spent years playing the credit card game

- A responsible adult who’s never missed a rent payment but doesn’t have traditional credit gets tossed into the “too risky” pile

This isn’t just unfair – it’s a colossal business blind spot. Millions of creditworthy borrowers get shut out or overcharged because the system can’t see their true potential.

Building an AI-First Lending Platform

This is where Upstart’s story gets juicy.

They didn’t just slap some AI onto an outdated lending process and call it innovation. Nope. They went “AI First” (pillar 3 of the UPGRADE Framework) and reimagined lending from the ground up.

It’s like the difference between adding GPS to a horse-drawn carriage versus building a Tesla. Same destination, completely different vehicle.

Upstart’s team flipped the script and asked:

“What if we could train an AI that sees the whole picture of a borrower – not just their credit history?”

The results? Their AI operates like that super-smart intern that keeps getting better (my “AI Intern” concept in action). It analyzes over 1,000 data points – education, employment, area cost of living, and hundreds more – to predict who will actually repay loans.

Why It’s Working (And Working Well)

Here’s where the rubber meets the financial road.

Upstart’s approach delivers three game-changing wins:

- More people get credit – Their models approve 43% more borrowers at the same loss rates as traditional methods

- Lower interest rates – Borrowers save an average of 4 percentage points (that’s thousands of dollars in your pocket)

- Lightning-fast decisions – Over 80% of loans need zero human intervention (the “You-Do-You” 20-60-20 model in perfect action)

This isn’t just a little business improvement – it’s transformational.

By now, Upstart has originated over $30 billion in loans and partnered with more than 100 banks who want to ride this AI wave.

Business Impact: AI That Means Business

Upstart nailed the “Prioritize the Opportunity” pillar of UPGRADE. They didn’t try to boil the ocean – they identified a specific, high-ROI problem where AI could make magic happen: risk assessment in lending.

The results? Simply stellar:

- Successful IPO in December 2020

- Expanded from personal loans into auto loans and small business lending

- Built a platform other financial institutions now depend on

- Created a more inclusive financial ecosystem serving previously excluded populations

Remember the Blockbuster vs. Netflix story?

This is the financial version. Traditional lenders are Blockbuster, still charging late fees while Upstart is streaming personalized recommendations.

Your AI UPGRADE Opportunity

You don’t need to be in finance to extract the AI gold from Upstart’s playbook.

Here’s your actionable takeaway:

- Apply the Focus Filter: What rigid, one-size-fits-all process in your industry is begging for an AI makeover? (Remember: you’ll always miss the right opportunity if you’re distracted by the wrong one.)

- Embrace the AI Growth Stack: What hidden variables might better predict outcomes in your business that traditional metrics miss?

- Go AI First: Don’t just add AI to your workflow – reimagine your entire business model with AI at its core.

Ready to UPGRADE Your Strategy?

Yesterday’s innovation is today’s expectation.

The companies that’ll crush it tomorrow aren’t just using AI as a feature – they’re leading with it as a strategy.

So – what outdated process in your industry is screaming for an AI revolution?

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

This is part of our AI UPGRADE Showcase series. For more on implementing the UPGRADE Framework in your business, check out our resources or book a strategy session. Let’s turn AI potential into business performance.