This AI UPGRADE Showcase spotlights companies that aren’t just dipping their toes in AI – they’re diving in headfirst. These organizations show us what happens when you stop seeing AI as a tool and start seeing it as a strategy.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

🔍 The Innovation Snapshot

Company: Lemonade, Inc.

Founded: 2015

Headquarters: New York City, USA

Sector: Insurance Technology (InsurTech)

The Big Idea: Using AI to transform insurance from a necessary evil into a social good

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The Problem Worth Solving

Let’s be honest about traditional insurance for a second.

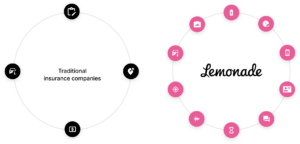

The whole industry is built on an inherent conflict of interest. Every dollar an insurance company pays out in claims is a dollar that doesn’t go to their bottom line. This creates a system where, by design, the company’s interests are directly opposed to yours when you need them most.

The whole industry is built on an inherent conflict of interest. Every dollar an insurance company pays out in claims is a dollar that doesn’t go to their bottom line. This creates a system where, by design, the company’s interests are directly opposed to yours when you need them most.

The result? A deeply adversarial relationship. Mountains of paperwork. Endless phone calls. Weeks or months of waiting for claim approvals. And that nagging feeling that your insurance company is actively looking for reasons to deny your claim.

This fundamental misalignment has turned insurance into something most people dread dealing with – a necessary evil rather than a valuable service. It’s led to an industry with some of the lowest customer satisfaction and trust ratings of any business sector.

And let’s not even start on the inefficiency. The average traditional insurance company employs armies of people to perform repetitive tasks – assessing applications, processing claims, detecting fraud – that could be handled more quickly and accurately by AI.

Understanding the Potential

When Lemonade launched in 2015, they didn’t just see an opportunity to create a slightly better insurance company. They recognized the potential to completely reinvent the insurance model using AI.

This is a perfect example of the “U” in UPGRADE – “Understanding the Potential”. Lemonade’s founders, Daniel Schreiber and Shai Wininger, recognized that AI could do more than just automate existing processes. It could fundamentally transform the relationship between insurers and customers.

They asked a different question: What if an insurance company could use AI to align its interests with its customers? What if the entire business model could be restructured so that denying claims wasn’t profitable?

This insight led to Lemonade’s revolutionary approach – taking a flat fee from each premium, using the rest to pay claims, and giving the leftover money to charities chosen by customers. By removing the financial incentive to deny claims, they created a model where paying claims quickly and fairly became the default.

Going AI First

Lemonade didn’t just add some chatbots to an existing insurance framework – they built their entire company around AI from day one. This “G” in UPGRADE – Going AI First – is what sets them apart from traditional insurers trying to bolt AI onto legacy systems.

Lemonade didn’t just add some chatbots to an existing insurance framework – they built their entire company around AI from day one. This “G” in UPGRADE – Going AI First – is what sets them apart from traditional insurers trying to bolt AI onto legacy systems.

At the heart of Lemonade’s approach are two AI personalities:

- Maya: The friendly AI bot that helps customers purchase policies in minutes instead of days, asking just 13 questions but collecting over 1,600 data points to create nuanced risk profiles

- AI Jim: The claims-handling superstar who can assess, verify, and pay claims in as little as 2 seconds (yes, you read that right—2 seconds!)

This isn’t just a faster version of traditional insurance – it’s a fundamentally different experience. When you file a claim with Lemonade, you don’t fill out paperwork or call a claims adjuster. You open the app, record a video explaining what happened, and AI Jim gets to work.

The system runs dozens of anti-fraud algorithms instantly, cross-references your policy details, and in many cases, approves and transfers money to your bank account on the spot. For more complex claims, it routes to human specialists who have all the AI-processed information at their fingertips.

The result? Around 40% of claims are handled completely by AI with no human intervention necessary, and customers experience what feels like magic – insurance that actually works when you need it.

Prioritizing the Opportunity

What makes Lemonade’s approach so effective is that they’ve focused their AI efforts on the areas that create the most friction and frustration in traditional insurance – the “P” in UPGRADE for Prioritizing the Opportunity.

Instead of trying to use AI for everything, they’ve zeroed in on the most critical pain points:

Instead of trying to use AI for everything, they’ve zeroed in on the most critical pain points:

- The purchase experience: Replacing lengthy paper applications and broker meetings with a conversational AI that makes getting insurance as easy as chatting with a friend

- Claims processing: Transforming the most stressful part of insurance—filing a claim – into a seamless, instant experience whenever possible

- Fraud detection: Using AI to identify truly suspicious claims while fast-tracking legitimate ones, rather than treating every customer like a potential criminal

By focusing their AI investments on these specific areas, Lemonade has created a dramatically different customer experience that addresses the fundamental problems in insurance, not just the surface-level ones.

Why It’s Working

The results speak for themselves. Lemonade has:

- Grown to over 1.9 million customers across multiple countries and insurance lines

- Set world records for claims processing speed with AI Jim handling claims in as little as 2 seconds

- Maintained consistently high Net Promoter Scores in an industry known for abysmal customer satisfaction

- Donated over $10 million to charities chosen by customers through their Giveback program

What’s particularly interesting is how Lemonade’s approach creates a virtuous cycle. The AI-powered experience attracts more digitally-savvy, honest customers. These customers file fewer fraudulent claims. This allows Lemonade to approve legitimate claims faster and donate more to charity. The positive social impact attracts more like-minded customers, and the cycle continues.

This is what happens when you align business incentives with customer needs and then use AI to deliver on that alignment at scale.

The Business Impact

Beyond the impressive customer growth, Lemonade’s AI-first approach has delivered significant business advantages:

- Operational efficiency: Processing claims and policies with a fraction of the staff of traditional insurers

- Improved risk assessment: Using 100x more data points than traditional applications to create more accurate pricing

- Global expansion: Scaling into multiple countries and insurance lines (homeowners, renters, pet, car, and life) faster than would be possible with traditional infrastructure

- Brand differentiation: Creating a beloved brand in an industry where most companies are tolerated at best, hated at worst

Perhaps most importantly, Lemonade has proven that insurance doesn’t have to be a zero-sum game where either the company wins or the customer wins. By leveraging AI to create efficiency and transparency, they’ve built a model where both can win simultaneously.

Your AI UPGRADE Opportunity

You don’t need to be in insurance to extract valuable lessons from Lemonade’s approach. Here are a few takeaways for any business:

Rethink the fundamental model: Instead of using AI to optimize existing processes, could you use it to create an entirely new business model that better aligns your interests with your customers?

Make empathy scalable: How could AI help you deliver more human-feeling experiences to more customers without requiring more humans?

Create transparency through technology: Could you use AI to make your operations more transparent and build trust with customers who are increasingly skeptical of businesses?

The companies that’ll crush it tomorrow aren’t just using AI to do things faster or cheaper—they’re using it to do things differently. They’re creating business models that weren’t possible before AI, and they’re deploying that technology in ways that align their success with their customers’ success.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

This is part of our AI UPGRADE Showcase series. For more on implementing the UPGRADE Framework in your business, check out our resources or book a strategy session. Let’s turn AI potential into business performance.